There has been a lot of discussion in the last few months about the speculative buying of stock and options, especially by new millennial investors. CNBC commentator Jim Cramer recently called this "the most speculative market I've ever seen".

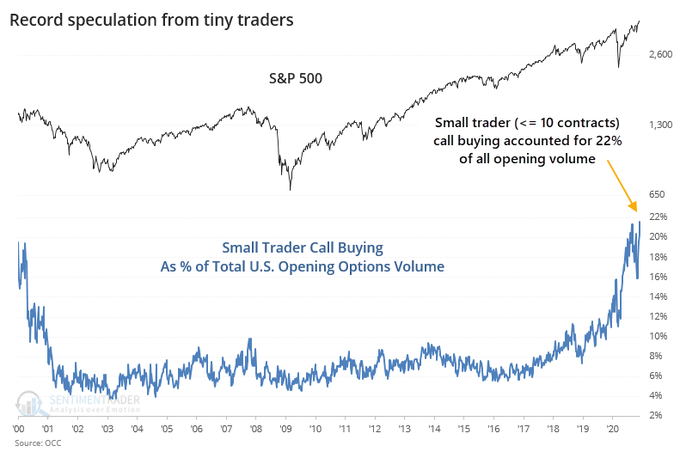

One of the most common trades by market speculators is Buying Call Options. During the last five trading days, volume in Put options has lagged volume in Call options by 67.31% as investors make bullish bets in their portfolios. As shown in the chart below, the volume of Call options has spiked dramatically upward this year to historic levels, indicating extreme greed on the part of investors.

And regarding the chart below: In a recent week, U.S. options traders opened 94.8 million new equity and ETF contracts. The smallest of traders buying Call options accounted for 20.5 million of those. At 21.6% of total volume, that's a record high (above the 1999-2000 dotcom bubble). Another sign of extreme greed!

Dare I say it? It seems like we have reached a stock market state of Euphoria -- an indication that a market top is likely here (or at least very near) and investor caution is advisable. As Covered Calls investors this would mean increasingly deeper in-the-money Covered Calls positions.

When the volume of Calls in individual stocks spikes much higher than their normal levels and their volume is much higher than their comparable volume of Put options, it is an indication of speculative excess. This is also accompanied by a substantial increase above the normal range of Implied Volatility for the company. As Covered Calls investors, one of our investing edges is taking advantage of the volatility risk premium -- the tendency of option premiums to be overpriced currently relative to their realized volatility going forward. So, we are willing to be the sellers of Call options to these speculative Call buyers -- and Covered Calls can be a relatively conservative means to achieve a good potential return-on-investment in these circumstances. In short, we counteract the greed factor apparent in Call buyers by taking the opposite side of the trade -- we are the Call sellers.

Normally, I avoid establishing Covered Calls in highly speculative companies, but I decided to explore the possibility. I ran a stock screener to identify some large-cap stocks that are extremely highly valued (Price/Sales Ratio > 20) and that also lost money during the last 12 months. Some of the companies you might have expected to appear on the list were, in fact, there including: CrowdStrike, DocuSign, DoorDash (that IPO'd just yesterday), Draftkings, Pinterest, Teladoc, and Zoom.

Of these companies, the one I find most compelling is Draftkings (ticker DKNG). So, I established a small Covered Calls position by purchasing 300 shares at $48.80 and selling 3 $45.00 strike Call options at the January 15th, 2021 expiration date for $6.56 per share. Not surprisingly, the Call option volumes in Draftkings greatly exceed that of the comparable Put options. Also, the Implied Volatility of the Call options sold was very high at 72.6 (compare this to the S&P 500 Volatility Index which is currently at 22.1), which provided a very attractive options premium received for the three Call options sold.

As detailed below, the potential return-on-investment result is +6.5% absolute return in 37 days (equivalent to a +64.4% annualized return-on-investment).Draftkings Inc. (DKNG) -- New Covered Calls Position

The simultaneous buy/write transaction was as follows:

12/10/2020 Bought 300 shares of Draftkings Inc. stock @ $48.80 per share

12/10/2020 Sold 3 Draftkings January 15th, 20210 $45.00 Call options @ $6.56 per share

Note: the Delta of these Calls was 68.0, which approximates the probability that the Calls will expire in-the-money at the Jan 15th options expiration.

A possible overall performance result (including commissions) would be as follows:

Covered Call Cost Basis: $12,674.01

= ($48.80 - $6.56) * 300 shares + $2.01 commission

Net Profit Components:

(a) Options Income: +$1,968.00

= ($6.56 * 300 shares)

(b) Dividend Income: +$0.00

(c) Capital Appreciation (If DKNG stock is above $45.00 strike price at the Jan 15th expiration): -$1,140.00

= ($45.00 - $48.80) * 300 shares

Total Net Profit: +$828.00

= (+$1,968.00 options income +$0.00 dividend income -$1,140.00 capital appreciation)

Absolute Return: +6.5%

= +$828.00/$12,674.01

Equivalent Annualized Return: +64.4%

= (+$828.00/$12,674.01)*(365/37 days)

The downside 'breakeven price' at expiration is at $42.24 ($48.80 - $6.56), which is fully 13.4% below the current market price of $48.80.