A buy/write limit order in NetApp Inc. (ticker NTAP) was executed today at the Covered Calls Advisor's net debit price of $85.08 per share. Two hundred shares were purchased at $88.78 and two April 11th, 2025 Call options were sold for $3.70 at the $86.00 strike price, a time value of $.92 per share = [$3.70 options premium - ($88.78 stock purchase price - $86.00 strike price)].

This position uses the Covered Calls Advisor's Dividend Capture Strategy (see here). NetApp has an upcoming quarterly ex-dividend of $.52 per share that goes ex-dividend one week from today on April 4th, 2025 which is exactly one week prior to the April 11th options expiration date. This is equivalent to an absolute annual dividend yield of 2.3% (at the current $88.78 stock price) and more importantly for this Covered Calls position, an equivalent annualized dividend yield of 15.3% = [($.52/$88.78) x (365/14 days-to-expiration)] for the 14 days duration of this position. This dividend increases the potential annualized return-on-investment results (compared with a similar position without a dividend capture potential) and the dividend is included in the detailed potential return-on-investment calculations shown below. Either an early assignment on the day prior to the ex-dividend date or on the April 11th, 2025 options expiration date would be a desirable result given the attractive annualized return-on-investment upon assignment for either outcome. The next quarterly earnings report is not until May 29th, 2025 which, as desired, is after the April 11th options expiration date.

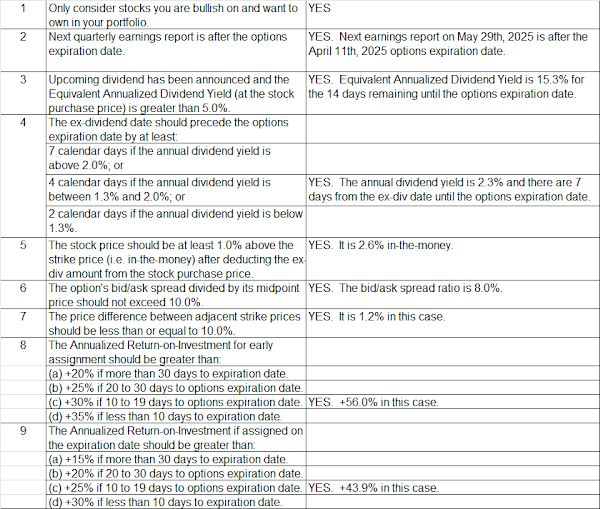

As detailed on the table at the bottom of this post, all nine criteria of

the Dividend Capture Strategy are met

with this position. The Covered Calls Advisor's current Overall Market Meter outlook is Neutral and an in-the-money strike price was used in this case. The probability that this position will be in-the-money and therefore assigned on its April 11th expiration date was 70.2% when this position was established this morning. There are 22 analysts covering NetApp and their average target price is $120.42 which is +35.6% above today's purchase price.

As detailed below, two potential return-on-investment results are:

- +1.1% absolute return (equivalent to +56.0% annualized

return-on-investment for the next 7 days) if the stock is assigned early (last business day

prior to the April 4th ex-dividend date); OR

- +1.7% absolute return (equivalent to +43.9% annualized return over the next 14 days) if the stock is assigned on the April 11th, 2025 options expiration date.

NetApp Inc. (NTAP) -- New Covered Calls Position

The simultaneous buy/write transaction was:

3/28/2025 Bought 200 NetApp Inc. shares @ $88.78.

3/28/2025 Sold 2 NetApp 4/11/2025 $86.00 Call options @ $3.70 per share.

Note: the Implied Volatility of the Call options was 29.5 when this position was established.

4/4/2025 Upcoming quarterly ex-dividend of $.52 per share.

Two possible overall performance results (including commissions) for this NetApp Inc. Covered Calls position are as follows:

Covered Calls Cost Basis: $17,017.34

= ($88.78 - $3.70) * 200 shares + $1.34 commission

Net Profit Components:

(a) Options Income: +$738.66

= ($3.70 * 200 shares) - $1.34 commission

(b) Dividend Income (If options exercised early on April 3rd, the last business day prior to the April 4th, 2025 ex-div date): +$0.00;

or

(b) Dividend Income (If Dell stock assigned on the April 11th, 2025 options expiration -- so the dividend is captured): +$104.00

= ($.52 dividend per share x 200 shares)

(c) Capital Appreciation (If NetApp Call options assigned early on Feb. 3rd): -$556.00

+($86.00 - $88.78) * 200 shares; or

(c) Capital Appreciation (If shares assigned at $86.00 strike price at options expiration): -$556.00

+($86.00 - $88.78) * 200 shares

1. Total Net Profit (If options exercised early): +$182.66

= (+$738.66 options income +$0.00 dividend income -$556.00 capital appreciation); or

2. Total Net Profit (If NTAP shares assigned at $86.00 at the April 11th, 2025 expiration): +$286.66

= (+$738.66 options income + $104.00 dividend income - $556.00 capital appreciation)

1. Absolute Return-on-Investment [If option exercised on business day prior to the April 4th ex-dividend date]: +1.1%

= +$182.66/$17,017.34

Annualized Return-on-Investment (If option exercised early): +56.0%

= (+$182.66/$17,017.34) * (365/7 days); or

2. Absolute Return-on-Investment (If NetApp shares assigned on the April 11th, 2025 options expiration date): +1.7%

= +$286.66/$17,017.34

Annualized Return-on-Investment (If NetApp shares assigned at $86.00 at the April 11th, 2025 options expiration date): +43.9%

= (+$286.66/$17,017.34) * (365/14 days)

Either

outcome provides an attractive return-on-investment result for this NetApp Inc. Covered Calls investment. These returns will be achieved as long as the stock is

above the $86.00 strike price at assignment. However, if the stock declines

below the strike price, the breakeven price of $84.56 = ($88.78 stock price - $3.70 Call options price - $.52 dividend)

provides 4.8% downside protection below today's stock purchase

price.

At least eight of the nine metrics used in the Covered Calls Advisor's Dividend Capture Strategy spreadsheet (see below) must be 'YES' prior to establishing a new Covered Calls position using the Covered Calls Advisor's Dividend Capture strategy. As shown in the chart below, all nine criteria are achieved for this NetApp Inc. Covered Calls position.